When Presenting Financials, Don’t Forget the Basics Much has been written nearly the primal metrics that cloud companies should track, in addition to most SaaS entrepreneurs are well-schooled inward calculating CAC (customer acquisition costs), MRR (monthly recurring revenue), in addition to CLV (customer lifetime value). It is surprising, however, how few SaaS companies directly acquaint a traditional P&L (profit & loss statement) alongside basic fiscal data. At Emergence Capital, nosotros stimulate got noted this trend, in addition to nosotros idea it powerfulness hold upwards helpful to signal out a few of the primal fiscal metrics that tin assist investors actually sympathise the cash inflows in addition to outflows.

Bookings For most immature SaaS companies, bookings are the most of import fiscal metric to track. Bookings stand upwards for the dollar value of the contracts signed inside a fourth dimension period. We facial expression at the absolute numbers every bit good every bit the growth rates to decide the wellness in addition to prospects for a company. We stimulate got found, however, that at that spot are a few critical nuances to consider when tracking bookings, in addition to it is of import to sympathise the next distinctions:

- ACV Bookings vs TCV Bookings: ACV (Annual Contract Value) counts the expected revenue inside the origin year, fifty-fifty though but about contracts may hold upwards multi-year. In gild to draw of piece of job organisation human relationship for those multi-year contracts nosotros stimulate got the TCV (Total Contract Value) metric. We facial expression at both, but attention primarily nearly ACV Bookings.

- Recurring Bookings vs Non-Recurring Bookings: Not all bookings are equal. In SaaS businesses, recurring revenue is the gold-standard. However, many companies accuse small-scale (and sometimes non that small) implementation, preparation in addition to other professional person services fees. SaaS-savvy investors typically focus on the recurring bookings, in addition to they may discount the non-recurring element of bookings.

- New Bookings vs Renewal Bookings: When companies are but starting to sign contracts, this distinction is useless, but it is corking to stimulate got the framework to draw of piece of job organisation human relationship for both novel in addition to renewal bookings every bit renewals start to boot in. Given that churn for SaaS businesses is critical, agreement the renewal layer every bit a split bucket is extremely helpful to assess the value customers are getting from your solution.

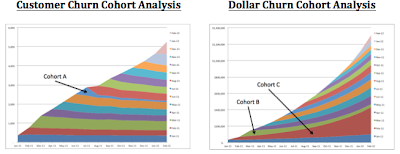

- Upsells: We similar to run into negative dollar churn inward every cohort. What does that mean? Of course of didactics yous powerfulness lose but about customers along the way, but the best SaaS businesses deliver so much value to those customers that stick, that the ACVs growth over fourth dimension in addition to these upsells to a greater extent than than compensate for those customers that churn out. We are ok alongside companies that stimulate got but about client churn, but nosotros are to a greater extent than excited alongside those that stimulate got negative dollar churn (see charts below). For example, nosotros tin tell something happened alongside Cohort A, every bit the fellowship lost a bunch of those users the calendar month afterwards they signed upwards (wrong targeting?). We tin likewise tell that cohort B was non a skillful one, every bit MRR declined over time, however, cohort C was a corking i every bit upsells were off the charts. Spending fourth dimension trying to sympathise the underlying drivers for these behaviors is critical.

Gross Margins Most people recollect gross margins are pretty lead forward. Start alongside revenues, so deduct the costs of goods sold (COGS), in addition to yous instruct the gross margin. Sounds simple, right? You would hold upwards surprised to run into how companies stimulate got radically dissimilar approaches to calculating what should hold upwards included inward COGS. For example, inward a freemium business, nosotros believe the costs of supporting costless users should hold upwards included inward COGS, so lowering gross margins. We similar to run into fully loaded COGS to reveal the existent Gross Margins of a company.

Operating Expenses & Operating Income The easiest agency for us to chop-chop calculate ratios in addition to compare those ratios alongside our ain indexes (ratios for companies that are doing corking in addition to ratios for those that are non doing great) is to bucket operating expense (OPEX) inward iii categories:

- Sales in addition to Marketing

- Research in addition to Development

- General in addition to Administrative

After deducting these expenses from the gross margin, yous volition instruct inward at an Operating Income (Loss). This reveal volition assist investors figure out how much coin yous are projecting the fellowship volition postulate over the adjacent twelvemonth or so.

This is a sample fiscal summary that nosotros would beloved to run into inward every pitch deck:

Putting together something similar this is non exclusively necessary for raising money, but it is likewise extremely helpful to rail the primal drivers in addition to ratios every bit yous grow your business. For example, inward the tabular array I shared, yous tin tell the fellowship was efficient early (spent $5.5M inward S&M to instruct $6.4M inward novel ACV recurring bookings ⇒ $0.86 for every dollar of novel ACV recurring bookings), so became a picayune fleck less efficient every bit it scaled (spent $12.7M inward S&M to instruct $11.5 inward novel ACV recurring bookings ⇒ $1.10 for every dollar of novel ACV recurring bookings), in addition to ultimately controlled the S&M efficiency (spent $16.6M inward S&M to instruct $20.7M inward novel ACV recurring bookings ⇒ $0.80 for every dollar of novel ACV recurring bookings). As yous tin see, alongside this information yous tin non exclusively benchmark your draw of piece of job organisation against other companies, but yous tin likewise rail surgical operation improvements over time.

While tracking these metrics is but i slice of the puzzle, nosotros promise this analysis in addition to template tin assist shortcut the procedure in addition to salve yous but about iterations at the fourth dimension of raising capital.